Operations in 2020

Wholesale business

Operations in Poland

PGNiG’s activities include the wholesale of natural gas produced from domestic fields and imported via pipelines and by sea. Through its specialised unit, the Wholesale Trading Branch, it trades in natural gas, LNG, crude oil, electricity, CO2 emission allowances, and property rights. The Wholesale Trading Branch is also responsible for the import policy and diversification of gas fuel supply sources to Poland.

As part of its business, PGNiG holds a licence to trade in gas fuels, trade in natural gas abroad, generate electricity, trade in electricity, liquefy natural gas, and regasify liquefied natural gas at LNG regasification plants.

Gas imports

In 2020, PGNiG purchased natural gas mainly under the long-term agreements and contracts specified below:

- Contract with PAO Gazprom/OOO Gazprom Export, for sale of natural gas to the Republic of Poland, dated September 25th 1996, effective until 2022 (the Yamal contract);

- Contract with Qatar Liquefied Gas Company Limited (3) for sale of liquefied natural gas, dated June 29th 2009, effective until 2034 (the Qatar contract), and supplementary agreement to the long-term agreement of March 2017 (effective from the beginning of 2018 to 2034);

- Contract with Cheniere Marketing International, LLP for sale / purchase of liquefied natural gas, dated November 8th 2018, effective until 2042.

Deliveries were also made under medium- and short-term grid and LNG supply contracts (including a 5-year contract, the execution of which began in 2018, for the delivery of nine shipments of liquefied natural gas from Centrica LNG Company Limited).

Imports of natural gas to Poland in 2016–2020 (bcm)

In 2020, the imported gas volume was 162.2 Twh (14.8 bcm). Gas purchases from the eastern direction increased slightly, with 0.5 TWh (about 0.05 bcm) more gas purchased from this direction relative to 2019. LNG deliveries increased significantly, from 37.6 TWh (3.43 bcm) in 2019, to 41.2 TWh (3.76 bcm) in 2020.

Following the conclusion of long-term contracts for the purchase of LNG at U.S. terminals in previous years, in 2020 PST chartered two tankers from the Norwegian shipowner Knutsen OAS Shipping to collect LNG contracted on a free-on-board basis. The two modern vessels, with a capacity of 174,000 m3 each, will become operational in 2023. The acquisition of the vessels will increase the flexibility of LNG purchases and sales and is another step towards developing the PGNiG Group’s trading activities on the global market. For more information, see Section 4.2.2.2.

PGNiG actively supports all efforts aimed at the construction of an infrastructural connection that would give Poland direct access to gas from North Sea fields. In January 2018, contracts were concluded for the provision of gas transmission services in the period from October 1st 2022 to October 1st 2037, as part of the 2017 Open Season procedure of the Baltic Pipe project, concerning gas transmission from Norway to Poland via Denmark. Conclusion of transmission contracts with transmission system operators, i.e. GAZ-SYSTEM and Energinet, with a total value of PLN 8.1bn, was the last stage of the Open Season 2017 procedure. For more information on the Baltic Pipe project, see Section 3.1.2.

Renegotiation of price terms under the contract with OOO Gazprom Export

On March 30th 2020, the Arbitration Court of Stockholm issued a final arbitration award whereby the pricing formula for the gas supplied by PAO Gazprom/OOO Gazprom Export under the Yamal contract was changed, including through its significant and direct linking to the prices of natural gas on the European energy market. Pursuant to the Yamal contract and the final judgment, the new contract price is applicable to gas supplies made from November 1st 2014, i.e. the date PGNiG formally requested that the contract price be renegotiated.

On June 5th 2020, an annex to the Yamal contract was signed between PGNiG and OOO Gazprom Export. In the annex, the parties confirmed the rules of applying the pricing formula for gas supplied under the Yamal contract as specified in the final award of the Arbitration Court in Stockholm. The annex also sets out the terms of mutual settlements between the parties of the financial consequences of applying the new pricing formula for the period November 1st 2014 − February 29th 2020. These included payments of approximately USD 1.6bn by Gazprom and approximately USD 90m by PGNiG, resulting in a net receivable to PGNiG of approximately USD 1.5bn.

On July 1st 2020, PGNiG received the entire amount of the refund from Gazprom. On July 2nd 2020, PGNiG made the agreed payment to Gazprom.

The prices under the Yamal contract may continue to change as both PGNiG and Gazprom filed requests for their renegotiation in November and December 2017, respectively. In addition, on November 1st 2020, PGNiG submitted a further request to Gazprom to reduce the contract price. Then, on November 9th 2020, Gazprom submitted a request to PGNiG to negotiate price increase. In the opinion of the Company, Gazprom’s claims are unfounded. PGNiG remains in contact with the supplier regarding these matters.

PAO Gazprom/OOO Gazprom Export filed two petitions with the Stockholm Court of Appeals: The first petition, of October 2nd 2018, to revoke the Arbitration Court’s ad hoc partial award of June 29th 2018. The Stockholm Court of Appeals, by its judgment of December 23rd 2020, dismissed the petition. The second petition, of May 29th 2020, for reversal of the final award issued by the Court of Arbitration. The case is pending.

LNG supplies

In 2020, PGNiG received a total of 35 LNG shipments to Poland, with a total volume of 2.70m tonnes, i.e. approximately 41.22 TWh or 3.76 bcm of natural gas after regasification, including:

- 18 shipments under long-term contracts with Qatargas, with the volume of LNG imports from Qatar totalling 1.64m tonnes, i.e. ca. 25.01 TWh or 2.28 bcm of natural gas after regasification;

- 13 spot deliveries;

- 2 shipments under the PGNiG Group’s medium-term contract with Centrica;

- 2 shipments under a long-term contract with Cheniere.

Sale of gas by PGNiG

Customers buy gas from PGNiG at market prices, in line with the formulas and pricing mechanisms set out in the contracts. The prices in contracts executed by PGNiG are established on a case-by-case basis using a uniform, objective pricing methodology. Settlements with customers are based on pricing formulas or fixed prices linked to exchange indices.

In 2020, PGNiG successfully continued its sales strategy and retained the customer base. The largest amounts of natural gas are sold in Poland to industrial customers, including: PKN ORLEN S.A., Grupa Azoty S.A, Grupa LOTOS S.A., PGE Polska Grupa Energetyczna S.A., KGHM Polska Miedź S.A. and the ArcelorMittal Group.

In June 2020, PGNiG and PKN ORLEN S.A. executed an annex to the contract for gas supplies to the PKN ORLEN Group, extending the contract term until December 31st 2022, with an option to extend the term by another 12 months until December 31st 2023. Also in December 2020, PGNiG and PKN ORLEN S.A. extended the term of the Individual Contract between the parties until December 31st 2027, with an option to extend the term until December 31st 2028, and amended the contract to cover supplies of gas to the planned Ostrołęka C Power Plant.

In 2020, PGNiG’s sales of high-methane grid gas in Poland amounted to 184.7 TWh (ca. 16.8 bcm). Year on year, the sales grew by 5.4%, from 175.3 TWh (16 bcm).

Sale of gas by PST

In 2018, PST opened a branch in Poland to establish relations with gas supply customers in Poland and subsequently across Europe, building on the existing relationships with subsidiaries of international companies based in the country. In 2019, a separate customer portfolio was transferred from PGNiG to PST (the last contract was transferred in January 2020).

As at December 31st 2020, PST supplied gas (E gas) to 20 customers (41 points of delivery in Poland). The customers of the Polish Branch of PST are the largest private businesses from the glass, ceramic, food and agricultural industries, receiving gas fuel for their own needs at physical points of delivery, as well as wholesale customers taking gas fuel at virtual or physical point of delivery for subsequent resale.

Exports

In 2020, PGNiG continued to sell natural gas to the Ukrainian market, mainly in cooperation with the ERU Group and other leading traders on the Ukrainian market. The sales to Ukraine totalled 1.24 bcm (13.6 TWh) of natural gas. Gas was sold both at the Polish-Ukrainian border and in the Ukrainian storage system under the Customs Warehouse Regime (CWR). The Company monitors growth opportunities on the Ukrainian market.

Gas sales on PPX

The volume of gas sold by PGNiG on PPX in 2020 (for delivery in 2020) was 105.8 TWh (9.52 bcm) and increased by approximately 8.1 TWh compared with the 2019 volume.

Small-scale LNG sales

In response to the growing market demand, in 2020 PGNiG continued the dynamic development of its small-scale LNG business, where gas is sold in the form of LNG transported by road tankers to regasification facilities or stations with no access to the distribution network. The volume of fuel delivered to end users in the form of liquefied natural gas is growing steadily. In 2020, 3,385 LNG tankers were loaded in Świnoujście (2019: 2,306). The aggregate amount of LNG the Company placed on the market was 80.1 thousand tonnes, of which 59.5 thousand tonnes was sourced through Świnoujście and 20.6 thousand tonnes from Odolanów and Grodzisk Wielkopolski. In total, in 2016-2020, the Company placed 278.7 thousand tonnes of LNG on the market, including 170.3 thousand tonnes from the LNG terminal in Świnoujście and 108.4 thousand tonnes from the Odolanów and Grodzisk plants. In addition, PGNiG has transshipped more than 4,000 tonnes of LNG onto tankers at the small-scale LNG terminal in Klaipėda since April 2020.

Sales of electricity

PGNiG’s business on the electricity market primarily involves wholesale trading, to provide PGNiG Group companies with access to the market. Total sales of electricity to trading companies and on the Polish Power Exchange accounted for more than 90% of PGNiG’s total electricity sales in 2020. PGNiG provided commercial balancing services to PGNiG TERMIKA and PGNIG TERMIKA EP, as well as commercial and technical operator services to PGNiG TERMIKA.

Capacity market

As a result of the auctions organised by Polskie Sieci Elektroenergetyczne S.A. in 2018, 2019 and 2020 (related to the implementation of the capacity market and the capacity obligation), PGNiG concluded the following agreements:

- power plant at the Wierzchowice storage facility – annual supply contracts for 2021–2025 (net capacity of 17 MW);

- Radoszyn-Lubiatów-Połęcko generating units complex – annual supply contracts for 2021–2023 (net capacity of 4.5 MW);

- Radoszyn-Lubiatów generating units complex – annual supply contract for 2024, net capacity of 3.5 MW.

Wholesale business abroad

Through PGNiG Supply & Trading GmbH, the PGNiG Group is developing its operations in Europe in three main areas: international LNG trading, access to the European gas market, including gas from the North Sea Continental Shelf, and wholesale on the markets of Central and Eastern Europe.

As part of its business, PST holds a licence to trade in gas fuels in Poland, Germany, the Netherlands, Belgium, Austria, Norway (Gassled System), the United Kingdom, France, the Czech Republic, Slovakia, Ukraine and Hungary. PST is an active player on organised markets (exchanges) and in OTC trading. It trades with over 150 counterparties under EFET (master agreements for trading in gas and electricity) or similar standardised contracts. In order to conduct trading activities on the global LNG market, the company has established a branch in London.

In order to be able to start receiving gas from fields on the Norwegian continental shelf, PST was registered with the Norwegian Gassled system operated by Gassco (Shipper Agreement). PST is also registered as a shiper (gas intermediary) and a participant in the gas storage system in Denmark, Slovakia and Hungary. PST is a market maker on the PEGAS exchange for the GASPOOL gas hub market area. It continues trading in futures contracts for Brent crude and gas in the US Henry Hub, through the following exchanges: ICE Futures Europe and ICE Futures U.S. It also sells electricity on the German market in exchange (EEX) and OTC transactions.

Sales of PST, including its subsidiaries, by product (in volume terms)

Sales of PST, including its subsidiaries, by country (in volume terms)

Product sales and activities in 2020

In 2020, PST sold 71.9 TWh of pipeline-supplied gas (including 11.6 TWh of gas from PGNiG UN and LOTOS Group S.A.), 13.2 TWh of LNG and 3.2 TWh of electricity in exchange and OTC transactions. Poland was PST's largest market for deliveries, where 50% of the volume was sold, while the German and Dutch markets accounted for 26% and 20% of sales respectively. The sales volumes (especially gas sales) declined year on year due to the COVID-19 pandemic.

In 2020, fourteen LNG shipments contracted by PST were received at the Świnoujście terminal. In 2019, PGNiG received 12 shipments at the Świnoujście terminal.

On October 1st 2019 PST began to receive gas from LOTOS Exploration & Production Norge AS, under a contract for supply of gas produced in license areas located on the Norwegian Continental Shelf (NCS). The volume of gas received under the contract in 2019 was 1.9 TWh, and 6.2 TWh in 2020. PST also receives gas produced by PGNiG UN on the German coast. In 2020, PST signed three additional contracts for the supply of gas from the NCS/Danish Continental Shelf (DCS) area. Gas deliveries from the new suppliers started in October 2020 (Aker BP) and December 2020 (DNO), and supplies from Ørsted partner will start in 2023.

Retail business

Retail business in Poland

On August 1st 2014, PGNiG OD was spun off from PGNiG to conduct retail sale of natural gas and provide retail customer services. PGNiG OD focuses on the sale of natural gas (purchased mainly on the PPX), electricity, compressed natural gas (CNG), and liquefied natural gas (LNG). As part of its business, PGNiG OD holds a licence to trade in gas fuels and in electricity.

Sources of gas

High-methane gas is procured from three main sources:

- Purchases of gas on the Polish Power Exchange (PPX).

- Purchases of gas under a bilateral contract, with deliveries to a virtual trading point in the transmission network operated by GAZ-SYSTEM;

- Purchase of gas under a bilateral contract executed with PGNIG, with deliveries to a physical trading point in Słubice.

The largest share in the volume of high-methane gas purchases is attributable to transactions on the PPX. Apart from natural gas, PGNiG’s purchase portfolio also includes high-methane and nitrogen-rich gas, and liquefied natural gas (LNG). Nitrogen-rich gas and LNG are purchased under bilateral contracts with PGNiG.

Sales of gas

PGNiG OD’s customer base includes consumers and non-consumers (including in particular small and medium-sized enterprises). Customers are classified into tariff groups based on the following criteria:

- Type of gas fuel received: high-methane gas or nitrogen-rich gas;

- Contracted capacity;

- Annual contracted volume – for customers with contracted capacity of not more than 110 kWh/h;

- Billing system – as per the billing frequency applicable to customers with contracted capacity of not more than 110 kWh/h.

Group 1-4 retail customers purchase gas used mainly for cooking and for water and space heating, as well as in shop-floor processes. Households are subject to a gas tariff approved by the President of URE. In 2020, PGNiG OD applied the following gas fuel trading tariffs:

- Tariff No. 8 for the period from January 1st 2020 to June 30th 2020 – the prices of gas fuel decreased by 2.9% on the previous tariff. The subscription fees remained unchanged.

- Tariff No. 9 in the period from July 1st to December 31st 2020 – the prices of gas fuel decreased by 10.6% on the previous tariff. The subscription fees remained unchanged.

On December 17th 2020, the President of URE approved PGNiG OD Gas Fuel Trading Tariff No. 10 for the period from January 1st to December 31st 2021. The prices of gas fuel for all tariff groups were reduced by 4.5%. The subscription fees remained unchanged.

In the first half of 2020, PGNiG OD acquired over 155.1 thousand new retail accounts in tariff groups 1–4 (both high-methane and nitrogen-rich gas). Business customers buy gas both for the purposes of their industrial processes and for heating, and are billed at prices set in the business tariff and in special offers.

Sales of other hydrocarbons

PGNiG OD offers a range of LNG and CNG products and services addressed to end users. The company’s offer includes:

- Sale of CNG at CNG refuelling stations – to customers with CNG-fuelled car fleets;

- Sale of CNG along with infrastructure – a comprehensive service offered by PGNiG OD to transport companies, where gas fuel is delivered along with the necessary infrastructure;

- Sale of LNG fuel – to end users with own infrastructure for receipt of LNG deliveries (transport or manufacturing); Purchase of LNG and its transport to designated locations;

- Sale of LNG along with infrastructure – irrespective of how LNG is used by the end customer (transport or industry), a comprehensive service is offered where gas fuel is delivered along with the necessary infrastructure;

- LNG bunkering – in 2020, the development of LNG bunkering services was continued within PGNiG OD (a total of over 511 tonnes of LNG was sold for bunkering purposes). The service was implemented in ports under the authority of the Head of the Maritime Office in Szczecin, including Szczecin, Świnoujście and Police. Bunkering was carried out in the truck-to-ship technology, i.e. by using specialized cryogenic tankers directly from the quay.

With respect to sales of LNG, PGNiG OD focuses on industrial customers and the transport industry, while customers in the CNG segment are mainly municipal transport companies. Other CNG customers include commercial vehicles and retail customers. In 2020, contracts were concluded with LG Electronics of Biskupice Podgórne for the supply of LNG together with infrastructure, as well as with Miejskie Zakłady Autobusowe of Warsaw for the sale of LNG. CNG supply contracts were signed with urban sanitation companies (MPO) of Kraków and Warsaw, and the CNG supply contract with Miejskie Przedsiębiorstwo Komunikacyjne (municipal transport company) of Rzeszów was extended.

Business-to-customer sales policy (B2C)

The company has a limited ability to pursue an independent policy regarding sales of gas to retail customers due to the obligation to have its tariffs approved by the President of URE. The abolition of this obligation under current legislation is planned for January 2024.

The company is gradually expanding its offering to the retail base of more than 7 million accounts through sales of add-on products. In addition to the ‘Pomocna Ekipa’ handyman service launched in 2019, the following products were marketed in 2020:

- ‘Na Zdrowie’ package, offering easy and prompt access to medical services,

- “Doradca Prawny dla Ciebie” and “Doradca Prawny dla Firmy” legal service packages, which provide access to legal advice and reimbursement of lawyer’s fees.

Business-to-business sales policy (B2B)

The gas offering is based on special term-plans with fixed prices or variable prices indexed to selected stock exchange indices. Customers who do not wish to be bound by a fixed-term contract can opt for gas supplies based on the standard 'Gas for Business’ price list used in open-term contracts.

The development of product offers and pricing plans is based on segmentation analyses (with particular emphasis on price elasticity) and customer demand communicated through the sales network. An important element of the process is the monitoring of competitors’ activities and offers.

The company’s commercial policy results in a stable market share, which is due, among other things, to the level of customer satisfaction, a broad product portfolio and the service quality. There is also a parallel effect of the rising sales volume and growing margin on gas sales to business customers.

Gas fuel sales under emergency / standby / supplier of last resort procedures

In 2020, PGNiG OD acted as a ‘stand-by supplier’ and ‘supplier of last resort’ (in accordance with the Act Amending the Energy Law and Certain Other Acts of November 9th 2018). In 2020, following discontinuation of gas fuel supplies by E2 Energia Sp. z o.o., PGNiG OD ensured uninterrupted supply of gas fuel to the company’s customers. Customers taken over from other suppliers are billed at prices set in the retail tariff of PGNiG OD (consumers) or the ‘Gas for Business’ tariff (non-consumers), as applicable.

Sales of electricity

PGNiG OD’s customer base includes consumers and non-consumers who have concluded comprehensive service contracts for the supply of electricity or contracts for the sale of electricity. As of the end of 2020, the company supplied electricity to nearly 103 thousand delivery points.

In 2020, the electricity supply offering for businesses was modified both for larger customers (Tranche Product) and customers interested in simpler offers (fixed price under fixed-term price lists).

Retail business abroad

In the first part of 2020, sales of gas and electricity to end customers continued through PST's subsidiaries, i.e. PST Europe Sales GmbH and XOOL GmbH. Consistent with the change in the organisation’s strategic objectives, a decision was made to restructure the business and sell the entire retail operations. The adopted approach was to sell the client portfolio of both subsidiaries, completed by December 31st 2020.

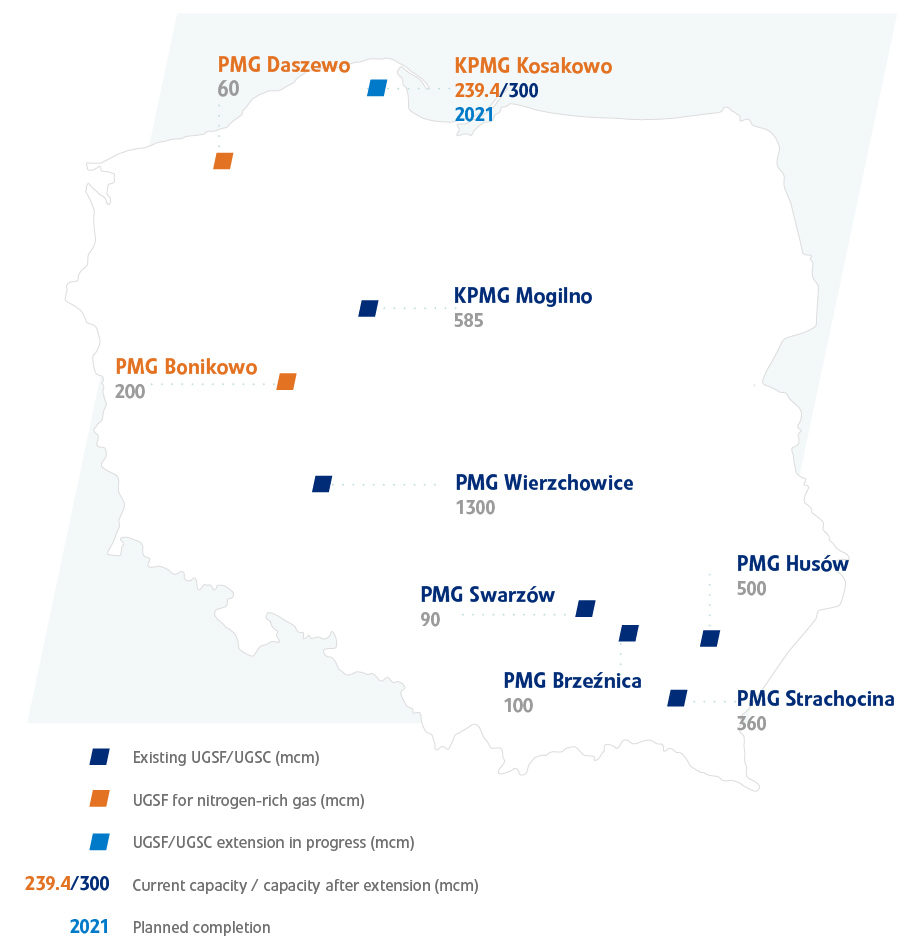

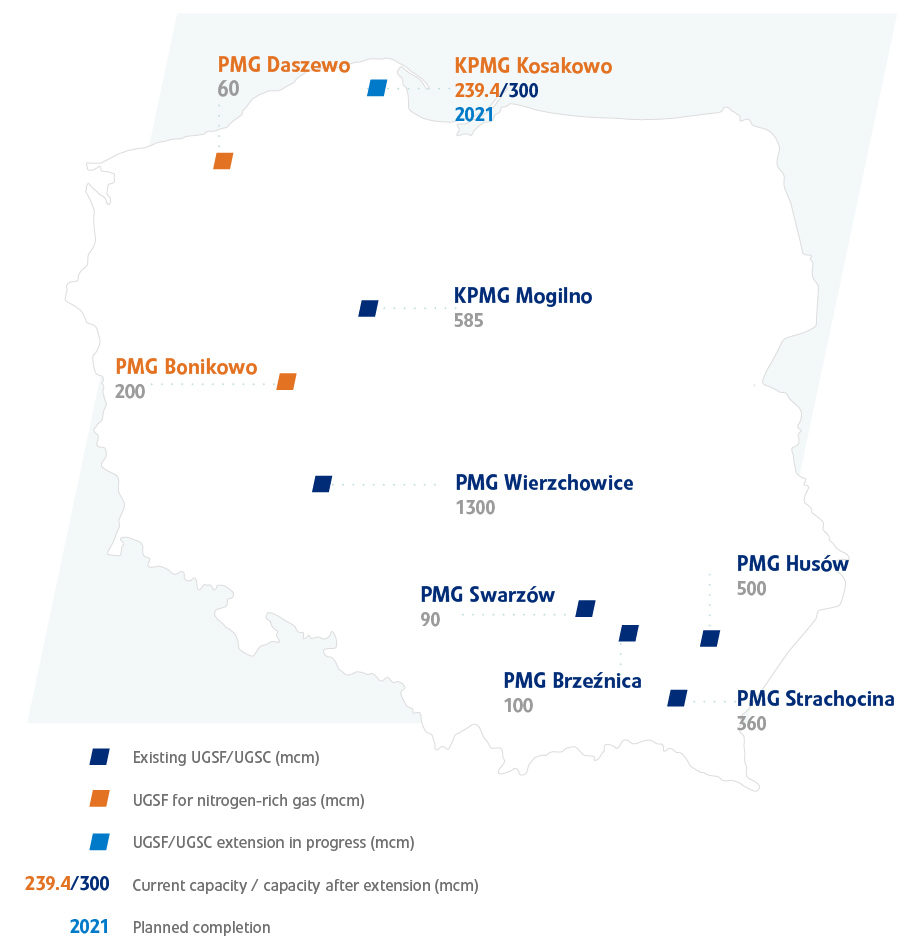

Storage

Gas Storage Poland (GSP) is engaged in storage of gas fuels in the following facilities owned by PGNiG: Husów UGSF, Wierzchowice UGSF, Strachocina UGSF, Swarzów UGSF, Brzeźnica UGSF, Mogilno CUGSF and Kosakowo CUGSF.

Source: In-house analysis based on data from the Geology and Hydrocarbon Production Branch and Gas Storage PolandAs part of its business, GSP holds a licence to store gas fuel in storage facilities.

Settlements of gas fuel storage services are subject to the following tariffs:

- Gas fuel storage tariff No. 1/2019, effective until 6.00 am on June 1st 2020 – the average rates for storage services decreased by 6.3% on the previous tariff,

- Gas fuel storage tariff No. 1/2020, effective from 6.00 am on June 1st 2020 – the average rates for storage services decreased by 1.2% on the previous tariff.

UGSF Mogilno and UGSF Kosakowo are peak-load storage facilities created in salt caverns and may be used, among other things, to smooth short-term movements in demand for natural gas. The capacities of the Wierzchowice, Husów, Strachocina, Swarzów and Brzeźnica UGSFs are used to balance out changes in demand for natural gas in the summer and winter seasons, to meet the obligations under take-or-pay import contracts, to ensure the continuity and security of natural gas supplies, and to meet the obligations under gas supply contracts with customers.

As the storage system operator, GSP provides gas fuel storage services to storage facility users under standardised procedures, on a non-discriminatory, equal-treatment basis, to ensure the most efficient use of the storage capacities. Storage services are provided under standard storage service agreements (SSSA).

The product offering is based on the Storage Facilities (SF) and Storage Facility Groups (SFG), i.e.:

- Kawerna SFG (comprising Mogilno UGSF and Kosakowo UGSF),

- Sanok SFG (comprising Husów UGSF, Strachocina UGSF, Swarzów UGSF and Brzeźnica UGSF),

- Wierzchowice SF.

Third-party access (TPA) storage capacities

As at December 31st 2020, GSP had a total working storage capacity of 3,174.8 mcm, of which a total of 3,139.6 mcm was made available, on a TPA basis and to GAZ-SYSTEM, as part of long-term services; 20.0 mcm, out of 30.0 mcm, of working capacity was made available as part of short-term services, on an interruptible basis, due to technical conditions. In addition, GSP allocated 5.2 mcm of working capacity for the needs of the Mogilno CUGSF’s and Kosakowo CUGSF’s technological units.

Ticketing service – PGNiG

PGNiG offers a ticketing service which allows gas importers and traders to meet their gas-stocking obligations in accordance with the applicable Polish regulations. The Company performed ticketing service contracts concluded for the gas year 2019/2020 with six energy companies; in the gas year 2020/2021, the services are provided to four energy companies. The total volume of gas stocks held by PGNiG for other entities was over 370 GWh of natural gas in the 2019/2020 gas year and over 300 GWh of natural gas in the 2020/2021 gas year.

As part of the ticketing service, PGNiG maintains gas stocks in gas storage facilities operated by GSP.